Debit Card with Lowest Foreign Transaction Fee: Whether you’re traveling for business or pleasure, you are bound to get hit by crazy transaction fees when using your cards abroad. Banks rake in lots of money from their customers who aren’t willing to do the bare minimum of research before starting their trip. And that’s because in the last few years, there have been a number of companies that have sprouted up that can now provide you with an international debit card – and very low foreign transaction fees.

Wise Debit Card

Wise is one of my favorite travel cards. I’ve been using it for years without issue. They were called TransferWise but have rebranded to Wise.

Get your first foreign currency transfer fee-free when you sign up through this link.

Available to residents of these countries:

USA, UK, Canada, Europe, Australia, New Zealand, Brazil, Singapore, Malaysia, Japan and more

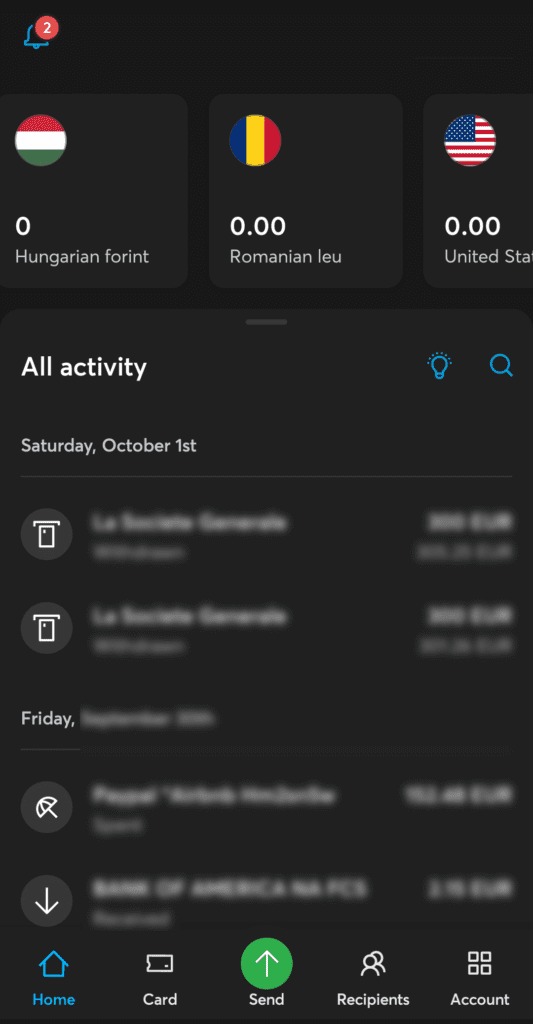

Switch between currencies on the fly

Transfer currencies in seconds in your account and see each balance individually. When traveling through multiple countries, this means that you’ll always have some local currency on hand.

Alternatively, you can just keep your main currency on your card and Wise will automatically do a cheap foreign currency exchange on-the-fly when you use your card.

You also get individual bank details for each one of your currencies. So you can easily accept payments and money transfers in any currency. This makes sending and receiving money while traveling a breeze.

Instant payment notifications

Get notified whenever a payment is made on your card. If you see a charge on your card that you didn’t make, you can instantly freeze your card.

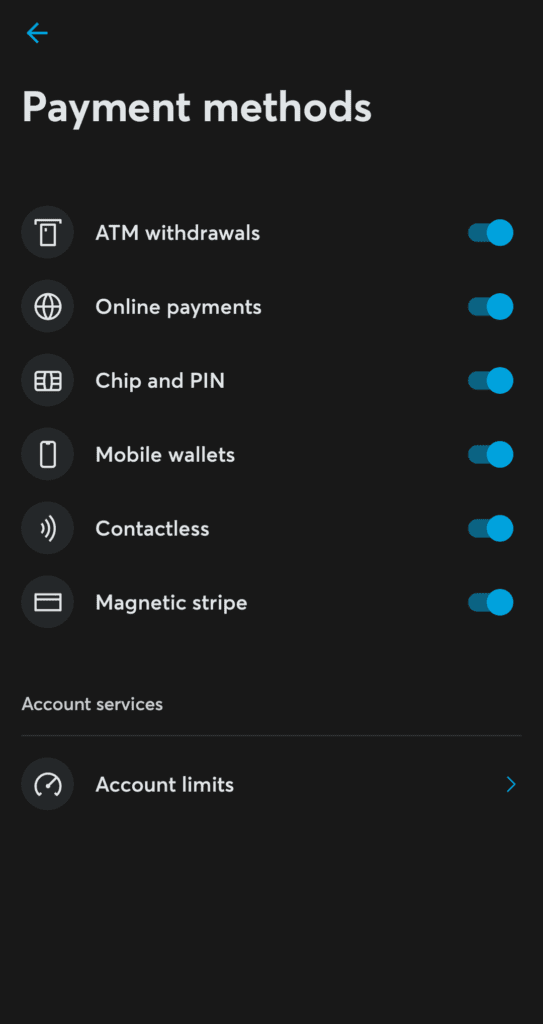

Switch Payment Methods On or Off

You can toggle different payment methods on/off from within the handy mobile app. This means that you can do things like prevent online purchases or cash withdrawals – or other payment types – with your card.

This gives you a lot more security and ensures that your card will only be used in the way that you intend it to.

If you don’t ever make ATM withdrawals, then simply switch it off. If someone who knows your PIN ever tries to withdraw cash – it will be declined. It’s an easy way to secure your card, and I’m not sure why more banks don’t offer these features.

Digital Cards

With Wise, you can create digital cards from within the mobile app. Use the digital card number for online purchases and then delete that digital card.

Now, even if someone steals that card number, they will be unable to charge anything else to it. This is also great for free trials that require a card number. Sign up, delete your digital card number, and never have to worry again about forgetting to cancel trials.

I use digital cards for every online purchase and delete them immediately after. You would typically have to pay for a service to get digital cards, but with Wise – it’s completely free.

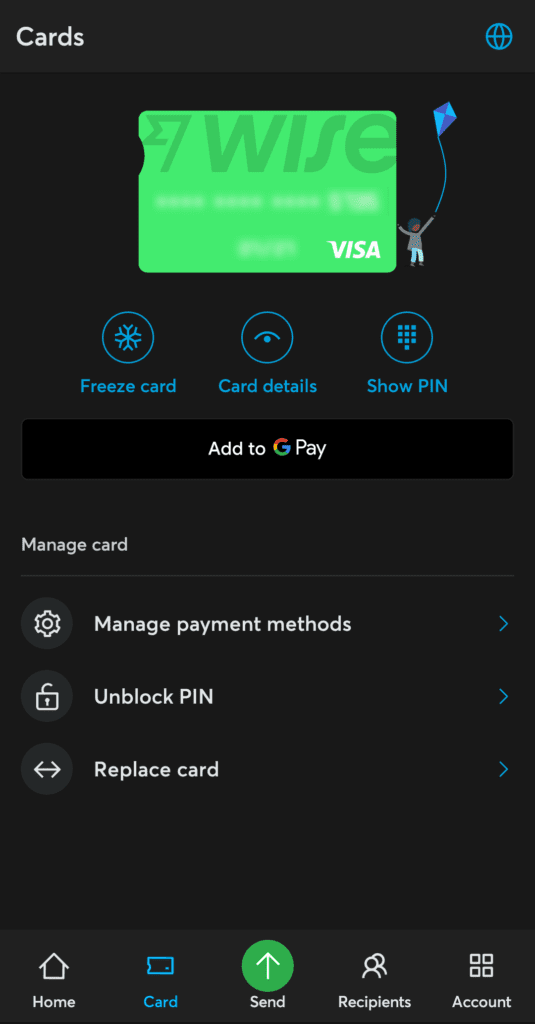

Instantly freeze and unfreeze cards

If you ever lose your card, simply freeze it in the app. Now, it will be useless to anyone that picks it up. If you find it, simply unfreeze it to start using it again. You can also order a new card from within the app, if it was stolen.

If you forget your PIN and input incorrectly 3 times, it will be blocked. You can unblock it right from your app as well, if you want to retry.

You can also add your card to Google Pay as well for even more convenience.

Withdrawing Cash

When in a European country, you’ll be able to withdraw €200 without any fees from ATMs/cash machines. After you’ve used your free amount, there is a basic charge of 1.75% + €0.50 per withdrawal.

Revolut Debit Card

This is another favorite of mine. These cards aren’t available in as many countries as Wise, but they are a great travel cash card for easy currency conversion.

Get your Revolut card here.

Available to residents of these countries:

USA, UK, Canada, Europe, Australia, Singapore, and Japan

Switch between currencies on the fly

Transfer currencies in seconds in your account and see each balance individually. When traveling through multiple countries, this means that you’ll always have some local money on hand.

Alternatively, you can just keep your main currency on your card and Wise will automatically do a cheap foreign currency exchange on-the-fly when you use your card.

You also get individual bank details for each one of your currencies. So you can easily accept payments and money transfers in any currency. This makes sending and receiving money while traveling a breeze.

Instant payment notifications

Get notified whenever a payment is made on your card. If you see a charge on your card that you didn’t make, you can instantly freeze your card.

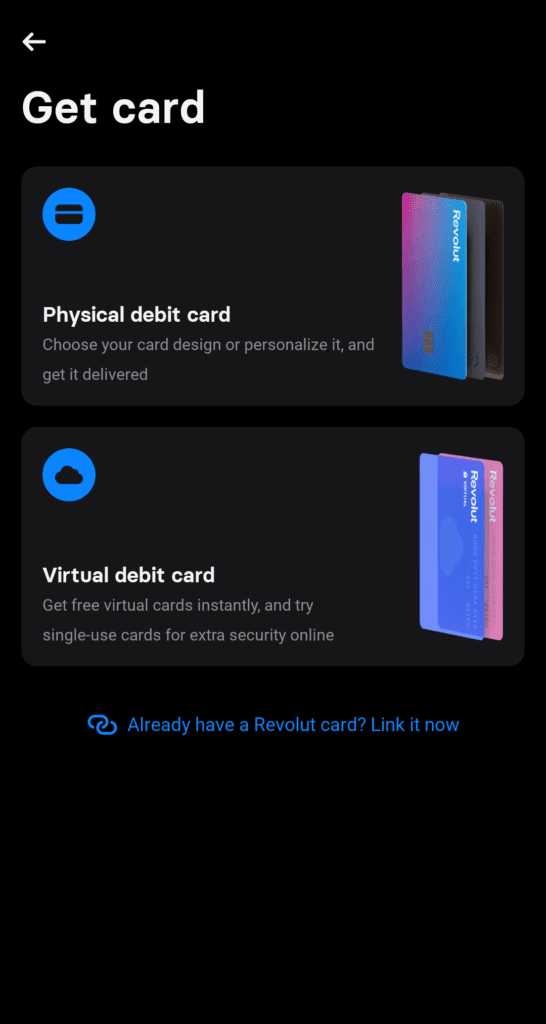

Digital Cards

With Wise, you can create digital cards from within the mobile app. Use the digital card number for online purchases and then delete that digital card. Now, even if someone steals that card number, they will be unable to charge anything else to it.

This is also great for free trials that require a card number. Sign up, delete your digital card number, and never have to worry again about forgetting to cancel trials.

Revolut also has one-use virtual cards. These automatically change their card number whenever they are used. In this way, every company can only make use of that number once and cannot charge you again later on that card.

Instantly freeze and unfreeze cards

If you ever lose your card, simply freeze it in the app. Now, it will be useless to anyone that picks it up. If you find it, simply unfreeze it to start using it again. You can also order a new card from within the app, if it was stolen.

Switch Payments Methods On or Off

You can toggle different payment methods on/off from within the handy mobile app. This means that you can do things like prevent online purchases or cash withdrawals – or other payment types – with your card. This gives you a lot more security and ensures that your card will only be used in the way that you intend it to.

Reset Contactless Limit

If you love making contactless payments but hate being regularly asked for your pin – you can simply reset your contactless limit whenever it is almost reached.

Setup GPS Location-Based Security

Use your location to prevent fraudulent charges. This means that your phone will have to be local to your card in order for it to be able to work. This means that if your card is stolen, it will be useless to the thief.

Buy Stocks and Crypto Directly in Revolut

You can purchase and store both stock and crypto through the Revolut mobile app. There’s no need to have different apps for all your investments when you can do everything directly in Revolut.

Get started with investing without having to learn difficult tools. You will be able to buy and sell U.S. listed stocks and ETFs with Revolut Securities.

Invest in 2,000+ global companies’ shares directly in your mobile app.

Get the latest market news and companies’ performances in-app. You can also be notified whenever a stock you’re interested in hits your desired buy-in price.

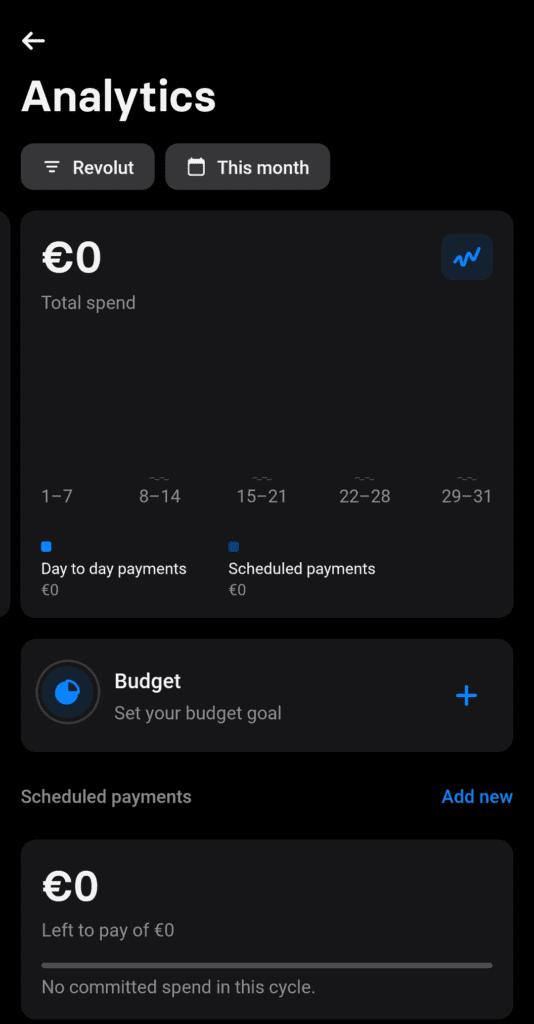

Analytics and Budget Options

Revolut also keeps track of your spending and has tools to help you budget better. Get notifications when you’re going to run over budget, and get weekly insights on your spending habits.

Revolut can actually calculate limits to recommend to you based on your spending predictions.

The smart analytics in the app will give you a clear view of your spending with a breakdown by merchants, categories, countries, and more

Withdrawing Cash

Free withdrawals up to 5 ATM Withdrawals or €200 a month (whichever your reach first). After that, there’s a 2% fee for each withdrawal, subject to a minimum fee of €1.

Debit Card with Lowest Foreign Transaction Fee

Both of these cards have very low foreign currency exchange transaction fees. I usually find that the rates I get from these two cards are generally about the same. Both have excellent apps and support for their customers. I do use Wise a lot more day-to-day but that is just more of a personal preference.

How to Best Use Travel Cards

I always travel with both of these cards. I keep one in my wallet while I’m out and the other one stored in the hotel safe. In this way, if I ever lose my card (or have it stolen), I simply freeze it and transfer my money over to my other account.

Having a second card also helps avoid withdrawal charges. If you’ve used up your free withdrawals on one card, simply transfer money over to your second card and use its free withdrawals.

Get your Wise Card here (get your first foreign currency transfer fee-free)

Get your Revolut Card here