If you’ve moved your business from abroad or receive international payment from overseas – you’re aware of how difficult it is to accept foreign currencies in South Africa. What should be simple is excruciatingly difficult. Stripe is one of the most popular payment gateways for online businesses, but unfortunately, they do not support South African Rand. And although they acquired Paystack back in 2020 – this did not improve acceptance of international payments at all. After painstakingly testing every payment gateway I could find – I’ve only found 3 stripe alternatives in South Africa that let customers pay in their own currencies (USD/EUR/GBP, etc) instead of in ZAR.

As I’m sure you’ve found out by now, payment gateways like Paystack, Payfast, Yoco, etc. can all accept international payments but require your customers to pay in South African Rands. From a customer’s point of view – seeing prices with lots of extra zeros at the end makes everything look way more expensive. A simple $10 product would be priced at R187.95 at today’s exchange rate. For anyone not from South Africa, it looks more like you’re inflating your prices. So, if we let customers pay in their local currency, we look more trustworthy and can make additional sales.

On most platforms, you will need to use a currency conversion plugin to show other currencies. Some plugins just show an estimated amount in the foreign currency, but still charge in Rands. While other plugins show the foreign currency and charge in that currency. My favorite WooCommerce multi-currency plugin is Currency Switcher for WooCommerce. Their free version lets you add 2 other currencies besides your primary currency option – which will be enough for most businesses.

1. PayPal

First on the list is PayPal. PayPal lets you accept almost any currency on the planet. Customers can pay using either their PayPal account or by using their credit/debit cards. PayPal is by far the easiest to setup and the most convenient option.

Your PayPal account can be setup in minutes, but verifying it and linking your PayPal to your FNB account might take just a little longer. If you use online banking, you could have it all done in under 30 minutes.

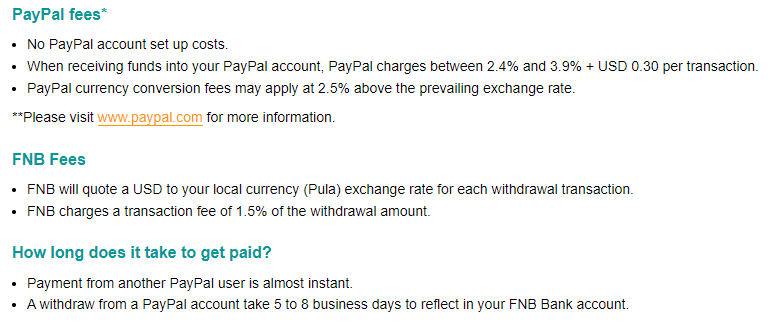

FEES – The PayPal and FNB integration does have higher fees than Stripe. There is the fixed PayPal transaction fee, a currency conversion fee, and an exchange rate fee that is charged by FNB. In total, this can add up to between 6% and 8% per transaction. Remember, FNB only changes USD to Rands, so if you accept payments in any other currency, you will have to pay a PayPal conversion fee to change it to USD, and a FNB conversion fee to change it to Rands.

2. Peach Payments

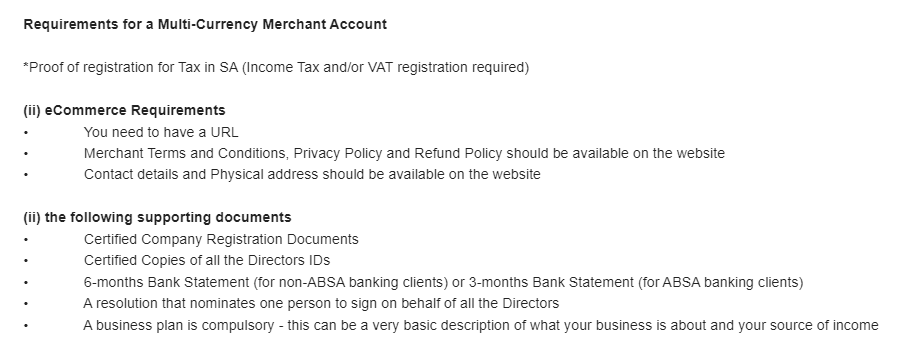

Peach Payments is another great option for receiving foreign payments in South Africa. It’s the closest you’ll find to Stripe – if you’re willing to go through the longer process to set it up. You’ll need to get an Absa Multi-Currency Merchant Account in order to receive international currencies. Peach Payments will provide you with the link to apply for the account and tell exactly what documents you’ll need to be accepted.

FEES – After a once-off setup fee of R250 – Peach Payments has a monthly fee, and a processing fee that comes up to R300 + R1.50 per transaction. Absa has their own fees or 3.3% per transaction and a Dynamic Currency Conversion rate of 5% per transaction. In total – you fees are 8.3% + R1.50 per transaction and a R300 monthly fee.

Opening an Absa Multi-Currency Merchant Account

Peach Payments will email you all the information you’ll need to open your multi-currency account, as well as the documents required.

3. 2Checkout

2Checkout is currently the last available option to accept foreign currencies in South Africa. Their setup is also quite lengthy with long waits between email exchanges, but if you know everything you need upfront – it’ll be much faster. You can get paid out from 2Checkout by wire transfer, Payoneer or PayPal.

In order to be accepted with 2Checkout, you will need to have made sales with any other payment gateway in the past (regardless of the currency). They want to see that you do not get a lot of chargebacks on your payments.

Checkout Box – The only reason that 2Checkout is not my number 1 choice is because the checkout box doesn’t look as great as the other options on this list. On the free version of the WordPress plugin, the checkout is processed on 2Checkout’s site. You can add inline/popup checkout but you will need to purchase the 2Checkout Pro plugin. In my tests, customers were only able to use their Amex and Discover cards for card payments, but for Visa and Mastercard payments, they will need to click on 2Checkout’s PayPal option to complete their payment. This is written in small text and is not very clear at first look. To avoid confusing customers, I prefer to use the other options on this list.

Getting Verified – Once you’ve signed up, you’ll need to complete a verification before you can start accepting payments. This will require you to fill in all the details of your business and then upload the following documents – valid government issued ID, proof of address, and copies of your last 6 months payment processing/paid sales history (screenshots as well as .CSV/.XLS files). You will also need to provide them with links to your website’s privacy policy, delivery policy and refunds policy (showing at least a 30-day refund policy). They have their own pre-made template links that you can use if your policies are similar enough.

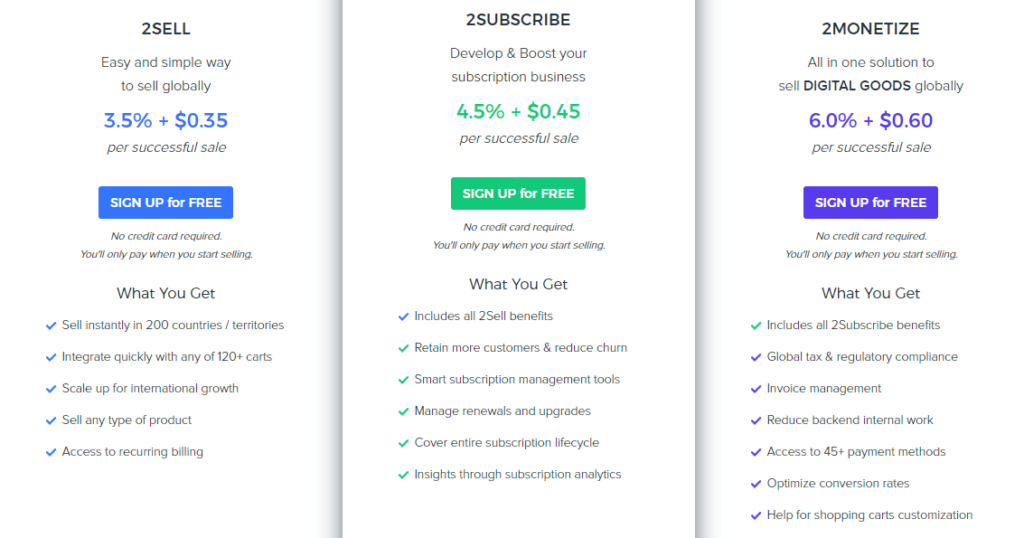

FEES – You’ll get the lowest fees using 2Checkout. It’s only 3.5% + $0.35 per sale. These fees are only applicable if your products are not hosted on 2Checkout. If you are selling digital goods and have them hosted on 2Checkout, then your fees will increase to 6% and $0.60 per sale. There will be additional fees depending on the method you use to payout, as you’ll need to convert the currencies into rands after the payout. If you want to improve the checkout for your customers, you’ll want the 2Checkout Pro plugin that costs anything from $49 to $449 – depending on your needs.

Stripe Alternatives in South Africa

And there you have it. Those are currently the only 3 Stripe alternatives in South Africa that let you accept foreign currencies. If you do have a lot of international customers – it’s definitely worth the extra fees to be able to display currencies in your customers local currency. It makes your site look much more trustworthy – which can lead to more sales.

If you use WooCommerce – you can also vote on their feature request page to have South Africa added to WooPayments. This would be the best alternative to Stripe, if it were to be added…

Hey there! I’ve been blogging for over fifteen years and have had the pleasure of writing for several websites. I’ve also sold thousands of books and run a successful digital sales business. Writing’s my passion, and I love connecting with readers through stories that resonate. Looking forward to sharing more with you!